ARLINGTON – A new federal tax incentive offers the potential to attract more private investment into Arlington’s advancing manufacturing and industrial sector.

Opportunity Zones were created as part of the Tax Cuts and Jobs Act of 2017 to offer incentives to people willing to invest in tracts of land designated by state and federal government ripe for economic development.

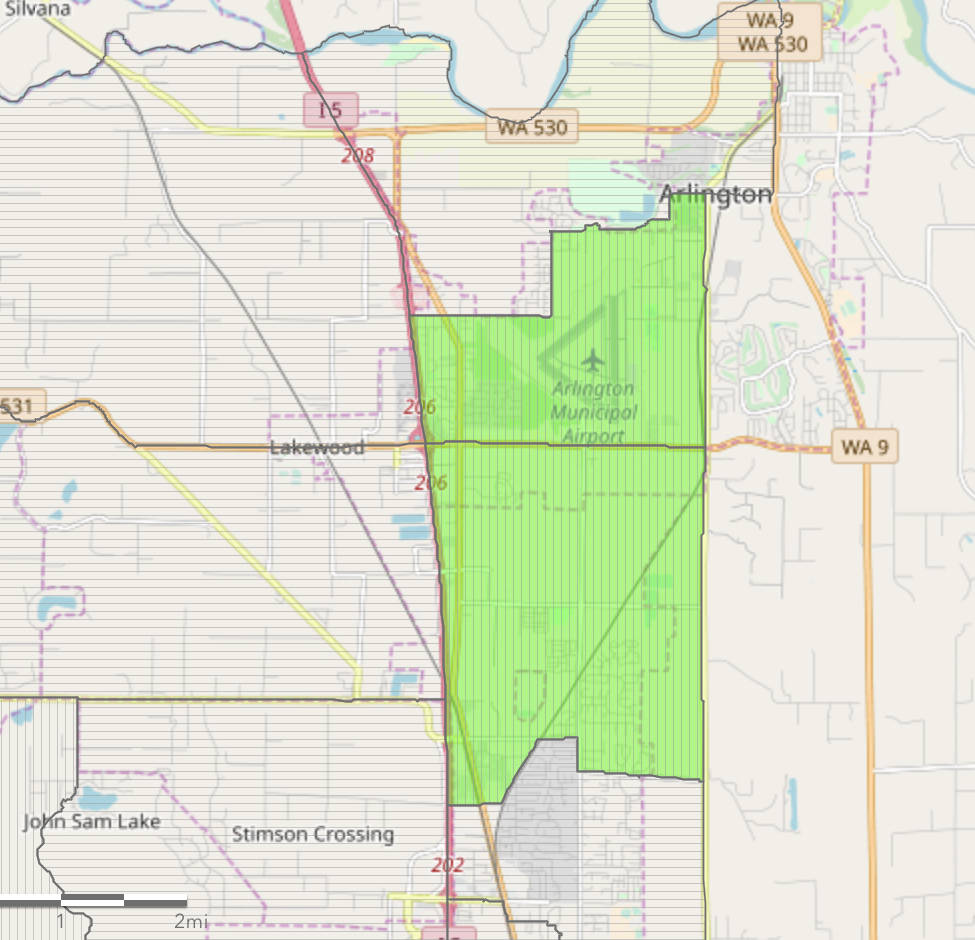

Gov. Jay Inslee last April approved 139 requests for Opportunity Zones. Eight areas are designated in Snohomish County; two overlay the Arlington-Marysville Manufacturing Industrial Center, which also includes the airport and downtown Arlington.

Mayor Barb Tolbert and City Administrator Paul Ellis attended an industry conference Oct. 2-3 in New Orleans hosted by Novogradac & Co., an accounting firm that specializes in tax credits. The sessions brought together private investors, bankers, equity firms, real estate developers and local governments to talk about the new community development incentive program

Leaders returned upbeat about the latest tool to foster investment for Arlington.

“The Opportunity Zone will be greatly beneficial to our recruitment of family wage employers to the MIC,” Tolbert said.

Ellis added, “The bottom line intent of the Opportunity Zones is really to create jobs.”

“We want to use it as an economic development tool,” he continued. “It’s an avenue for businesses that want to move here to get a higher return on investment, and realize some capital opportunities that they couldn’t get outside of an Opportunity Zone.”

A total of 555 census tracts in Washington met the eligibility criteria, though only 139 received the designation.

“Opportunity Zone status could be a useful tool to help strengthen these communities by encouraging capital investment,” said Brian Bonlender, director of the state Department of Commerce that is overseeing the program in Washington. “While we had many more requests than available tracts, I believe we ended up with a good balance of urban-rural and economic development and housing opportunities.”

Here’s how Opportunity Zones work. Some or all of a capital gain from an investment or property sale can be deferred for tax purposes within 180 days into a qualified Opportunity Zone fund. Those gains won’t be taxed until Dec. 31, 2026, unless the interest in the fund is sold or exchanged.

In addition, investors who keep their money in an Opportunity Zone project for five years can reduce the amount of those taxes by 10 percent, with another 5 percent cut if they stay with the project two more years. As an added perk, an investor can pay as little as zero in taxes on gains from an investment in an Opportunity Zone project if they hold off at least 10 years to sell their share in the project.

In return, the investments are supposed to give areas in need of economic development a boost by supporting projects that bring in businesses offering family wage jobs.

The tax break within the MIC would apply on top of an existing property tax exemption for 10 years on the construction of a new manufacturing building (building only, not land) in Arlington and Marysville. The building must be a minimum of 10,000 square feet, and the operation must create a minimum of 25 new jobs paying $18 or more per hour.

Ellis said the incentive can also be used for capital for equipment purchases and for startup operational capital.

In some circles, investors are also talking about using funds to create co-working spacing and innovation centers, much like the city of Arlington is pursuing with the Northwest Innovation Resource Center.

Ellis pointed out that Arlington’s market has mostly catered to manufacturers of the 20,000- to 50,000-square-feet variety.

Often, they are businesses relocating from Everett and Seattle. “They’re in areas that are already built out, and they can’t get enough space to expand.”

Ellis said the city has put together the elements that businesses say they need, including a qualified workforce, vocational programs, receptive government and regulatory consistency. Incentives such as the property tax exemption help. “The Opportunity Zone just adds one more layer.”

The nearest other Opportunity Zones in the county are located in parts of Everett and Paine Field.

While much of the program’s focus nationwide is on economically depressed areas, it runs the gamut by also targeting underserved communities with low to moderate incomes and inner-city areas looking to create jobs and spur economic development.